Let’s face it, in a perfect world, we would all hope that we could trust those in positions to make decisions on our behalf and that those decisions would make things better for us. However, the world is a complex place and bad decisions are made all the time – we read about them in the news, we hear about them from friends and neighbors.

In light of the crash of the world’s financial markets – renewed interest from government regulators has brought attention to the different type of trust-based services we utilize and who is qualified to make those decisions on our behalf. Stockbrokers, Investment Advisers, and Insurance Agents are all required to gather information about your risk tolerance, investment time horizon, and financial goals so they can recommend “suitable” financial products.

So then, what is a suitable financial product?

Suggesting to an elderly person living on small budget that they should invest in a highly volatile stock would probably not meet the suitability requirement. The client should not be in a high risk investment, and probably should be directed towards a product which produces regular income and has little risk of loss of principal instead.

A financial advisor can recommend many options but those options must make sense from a practical standpoint. There may be thousands of options that meet the suitability requirement for a certain type of client however, and not all those products are created equal. That is where the importance of a fiduciary comes in.

Then what is a fiduciary?

A Fiduciary has a legal duty which means that the person or firm you are dealing with is required to act in the best interests of their client, treating their recommendations and decisions as their top concern. In the example above, there might be several financial investment products which are suitable investments for the client. A Financial Advisor with a fiduciary duty would be required to recommend the best fund for the client. This is true even if they would receive a higher commission or other compensation by steering the client to a different option.

A financial adviser with a suitability requirement only (no fiduciary duty) could refer the client to a much broader variety of options – without this key distinction.

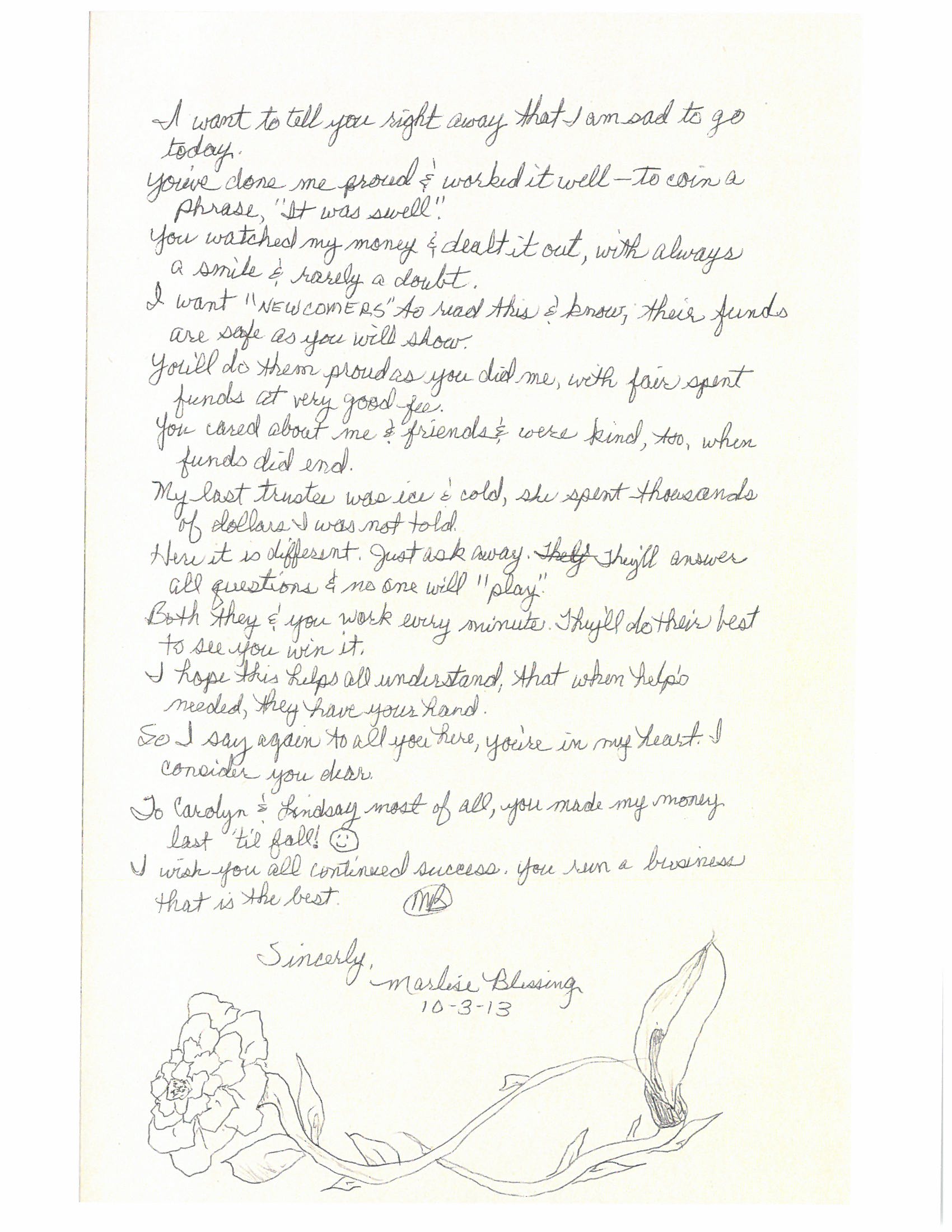

At CMY Fiduciary Services, we know that the adviser/client relationship must be based on trust so that all decisions moving forward can be made giving the client peace of mind and enabling the fiduciary to provide all the services needed on the clients behalf.

At CMY Fiduciary Services, financial advice is only one part of our list of client services. We also provide Executor Services, Trustee Services, Guardianship and Pre-Need Guardianship, as well as Health Care Surrogate and Attorney In Fact.

Contact a Fiduciary in Sacramento

When you retain the services of CMY Fiduciary Services, do so with the assurance and knowledge that as licensed fiduciary agents, our first priority and legal duty is to act in your best interest at all times. It is a relationship built on trust and one which we value highly.

Contact Carolyn M. Young today.